We live in a world where money is definitely seen as the gateway to success. It’s really true when they say, “money makes the world go round.” When it comes to purchasing a home or taking out a business loan, finances can play an important role in determining your eligibility and what kind of interest rate you will be stuck with. Most people who have gone through the process will agree—the lower the interest rate, the better!

Why?

Well, when it comes down to interest rates, they affect multiple aspects of a loan. Not only does the interest rate determine how much your monthly payment will be, but it also impacts how much it will cost you to take out a mortgage. While interest rates can vary from individual-to-individual, they can also change from country-to-country.

Loan interest rates are set by the country’s central bank funds rate, which is the rate that the banks can borrow money from the country itself. If the central bank fund rate is low, your mortgage interest rate will be low. However, if the rate is high, you’re looking at much higher interest rates. It’s also important to point out that inflation and a country’s credit rating also impact these factors as well.

If you’re looking to buy a home in the near future, or maybe you’re looking to take out a loan for a business, we thought it would be beneficial to provide a list of the countries with the lowest interest rates in 2017. While moving internationally may not have been your goal, you’d be surprised at how cost-effective it can be to pack your bags and go on a globe-trotting adventure!

We used the Global Interest Rate Monitor (GIRM) to pull together a list of 20 countries with the absolute lowest central bank interest rates. If you’re thinking of your next big purchase, it may be wise to consider taking out a loan in one of these countries due to the accessibility of borrowed funds.

20. Switzerland

Image: tapeciarnia.pl

There’s no country better than Switzerland when it comes to applying for a loan.; in fact, they actually have a NEGATIVE interest rate, which means the government will pay banks to lend them money. How awesome is that? Everyone benefits from this situation because it trickles down to the consumers. Therefore, if you’re searching for a new country to move to, Switzerland is the place to be.

19. Denmark

Image: Conde Nast Traveller

Another country with interest rates in the negative is Denmark. The country’s interest rate is currently sitting at -.65%, making now the perfect time to make a purchase if you’re a current resident or thinking about a change of scenery. We definitely suggest Copenhagen if you’re considering a move.

18. Sweden

Image: The Local Sweden

There’s definitely a common theme, here, when it comes to Europe and interest rates, as Sweden continues to stay in the negative as of May 2017. Personally, we’d love to get paid to take out a loan or mortgage. Plus, Sweden has some of the best cheese pies on the planet—if you haven’t tried Vasterbotten pie, you’re really missing out.

17. Japan

Image: Celebrity Cruises

According to the Global Interest Rate Monitor (GIRM), Japan’s national interest rate is currently sitting at -.10%. While not as attractive as Sweden or Denmark, any interest rate in the negative is the perfect opportunity to apply for a loan or mortgage. We definitely recommend checking out the Okinawa area, the cherry trees in bloom during the spring are quite the sight to behold.

16. Bulgaria

Image: Rough Guides

Bulgaria is known for being the Land of Roses because it produces 85% of the word’s rose oil. Even better, it has a 0% interest rate when it comes to loans and mortgages. How awesome is that? Whether you want to start a business in a quaint little village or move to the capital of Sofia, you won’t have to worry about paying out too much in interest.

15. Czech Republic

Image: Talentify

Another country with a low interest-rate is the Czech Republic. Home to the beautiful city of Prague, Czech Republic can be a dream come true for outsiders thanks to a national interest rate of .05%. It’s a good thing the interest rates are low because the average household in the Czech Republic makes roughly around $25,000 USD per year.

14. Israel

Image: UPI

Israel continues to have falling interest rates, with recent interest rates sitting at .10%. However, due to the Israeli-Palestinian conflict, we can’t recommend opening a business or turning it into your number one destination for retirement just yet. While the cities are breathtaking, there is simply too much drama in the country.

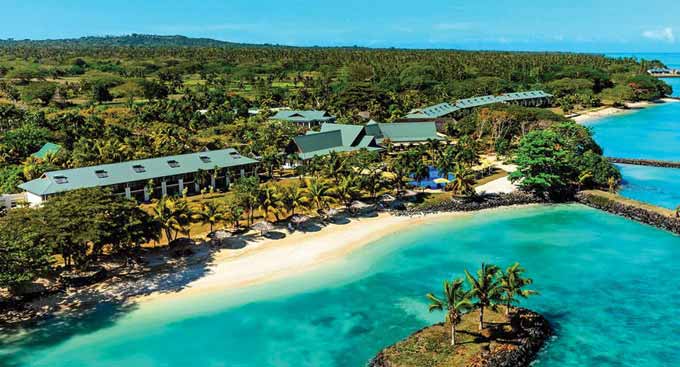

13. Samoa

Image: Somoa Travel

Now, we understand if Samoa may not be in your “top three” places to live, but their interest rates may change your mind. Thanks to low impacts of inflation and a generally high credit rating, Samoa’s interest rate is currently .14%. Boasting a mild tropical climate and gorgeous beaches, you could do a whole lot worse when it comes to finding a place to call home.

12. United Kingdom

Image: CIA.gov

If you’ve always dreamed of waking up every morning with a view of the Tower of London, then moving to the U.K. might be right up your alley. The current interest rates in the United Kingdom have stabilized at around .25%, making homes affordable and the possibilities of opening a business with a view of Stonehenge closer to a reality for some folk.

11. Canada

Image: Evaneos Travel

With the direction that the United States is headed, moving to Canada is definitely looking more attractive every day to many citizens. Fortunately, it wouldn’t be too far of a move for U.S. locals and the interest rates have stabilized at around .50% in the mortgage loan arena. Plus, Vancouver has a huge film industry, which means tons of opportunities to spot celebrities. Was that Tom Cruise who just walked by that tree?

10. Fiji

Image: Tourist Destinations

Who wouldn’t want to spend their days basking in the sun on the beaches of Fiji? And thanks to their low-interest rates of .50%, that dream could become a reality. While moving to Fiji would prove to be quite the task, the affordability of a home once you get there will definitely make up for it. Plus, just look at that view!

9. Norway

Image: Nordic Visitor

The country of Norway is relishing in low inflation rates at the moment, which has impacted their loan/mortgage rates by dropping them down to .50%. Besides the low interest-rates, living in Norway offers stunning vistas as well as cities that are major green spaces for the environmentally conscious. Personally, we think it sounds like a slice of Heaven.

8. Hungary

Image: Planetware

Located in Europe, Hungary is known for its capital, Budapest, and infamous landmarks (like the medieval Castle Hill). The country also has really low interest-rates for mortgage loans. Starting at .90%, it could definitely be tempting to leave your life and add a dash of international flavor.

7. United States

Image: Huffington Post

While it may not seem like it for some folks, the United States offers up comparatively low interest-rates. Currently, the country is sitting at 1%, thanks to even levels of inflation and a high credit rating. While individual states can vary in terms of interest rates, purchasing a house here is still cheaper compared to other countries.

6. Albania

Image: Rough Guides

Despite the political issues going on in the country, Albania is truly a beautiful place. From its rolling mountains to historical ruins, the country offers up a lot in the way of lush locales. You can also obtain a mortgage with a low interest rate of 1.25%. Thanks to low inflation rates, the country has been able to maintain lower interest rates for quite some time now.

5. Bahrain

Image: Bahrain Business News

While we understand if living in a small Arab monarchy in the Persian Gulf is not at the top of your bucket list, you can’t deny that a 1.25% interest rate isn’t attractive. Composed of about 30 small islands, life would definitely be exciting if you chose to make a change of scenery. You should definitely check out the thriving Bab-al-Bahrain bazaar, which offers the best spices and pearls in the world.

4. Finland

Image: Planetware

Finland currently offers an interest rate of 1.83% thanks to weak inflation and high credit ratings. Banks within the country are also willing to provide loans at LTV 100% with additional guarantees and insurance, so there are a variety of options for those looking for a change of scenery. The local cuisine is also a perk if you choose to make the move; personally, we’ve been dying to try the oven-baked cheese with cloudberry jam.

3. Germany

Image: Matador Network

We can’t imagine what life would be like living in Germany, but from what we’ve read it’s pretty amazing. From their excellent healthcare system to delicious local cuisine, Germany has a lot of perks, especially when it comes to mortgage rates. Currently, the interest rate is set at 1.90%, which is pretty low compared to Russia, which is experiencing 7.5% inflation. However, it’s important to point out that in order to obtain a mortgage in Germany, monthly payments must not exceed 35% of your salary.

2. Luxembourg

Image: US News

The small country of Luxembourg currently offers mortgage rates as low as 2%. Banks offer loans with a maximum LTV ratio of 80% for up to 30 years in the country, which is excellent for those looking to invest in a home. Known for the beautiful and dense Ardennes Forest, as well as the bustling hub of Luxembourg City, you could do a lot worse when it comes to picking a location to settle down.

1. Taiwan

Image: Viator

Surprisingly, Taiwan has managed to maintain a low interest-rate, in terms of mortgages, with a steady rate holding at 2.10%. While definitely the highest rate on our list, it certainly can’t compare to Argentina (where interest rates have skyrocketed to 27.7%).