Saving Money for Retirement vs. Paying Off Student Loans

More and more college graduates are leaving school with debt from student loans. In 2020, 65% of graduates had debt from student loans, totaling 44.7 million student borrowers with an average debt of $37,584 apiece.

It happens because of many factors, but financial illiteracy is particularly important. Before making the important decision to take out a student loan for the first time, you need to have a solid financial background. For instance, read every guide on how to apply for a loan, guide on best credit cards to build credit, or even take some courses.

Because of this, a whole generation is starting their careers with the dilemma of choosing between saving for retirement and paying down their college loans. Improving one’s financial future, starting a retirement savings plan, and paying off school loans are essential.

Additionally, grads don’t have to select between the two, which is wonderful news. It is feasible to balance debt repayment and retirement savings, albeit everyone’s ideal solution may differ slightly.

Saving for Retirement as Opposed to Paying Off Debt

Choosing between prioritizing 401(k) contributions or student debt repayment can be difficult for recent graduates and those in their 20s. Financial stability can be attained by paying off student loans, but retirement savings are also crucial because everyone eventually has to quit working.

Student Loans Cost

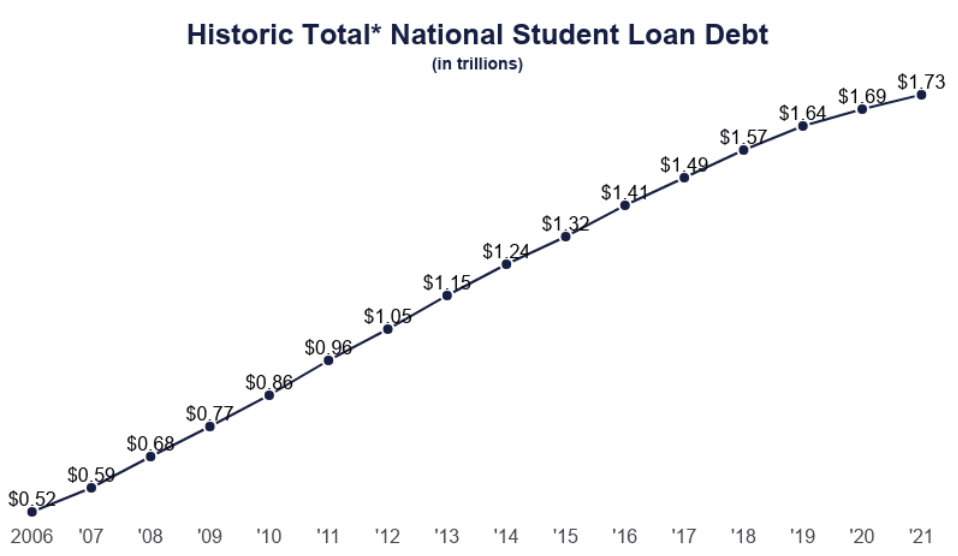

The majority of states indicate that 50% of recent graduates from four-year institutions have student loans, with amounts ranging from $18,350 to almost $40,000 per graduate. Unfortunately, student loan debt has been rising.

Furthermore, depending on the kind of loan program, interest rates on student loans can range from 5% to over 7%, with a typical loan length of ten years. The cost of student debt as it approaches repayment is seen here.

You will have forked up almost $10,000 in interest over ten years, totaling nearly $40,000.

Retirement Costs

Although the average student loan term is ten years, retirement can last 30 years or longer. Consequently, depending on when you stop working and how long you live, retirement costs might be significantly higher than your total student debt.

You’ll need to pay both living and medical costs in retirement (which will increase as you age). Usually, at least 80% of your revenue must be replaced. You’ll need to save enough money if your yearly income is $50,000 to have $40,000 in retirement. You will require at least $1 million ($40,000 x 25) for a 25-year retirement that begins at age 60.

Social Security is one potential additional source of income in retirement, but it’s unlikely to meet all of your costs. The typical Social Security benefit in 2021 was $1,555 per month or $18,660 for the whole year.

When to Prioritize Student Loan Repayment

Interestingly, 31% of Americans are opposed to forgiving student loan debt. Given the elements mentioned above, you ought probably to put off investing more money for retirement in favor of paying down your student debts if:

- The interest rate on your student loans is higher than the return on investment you may anticipate making.

- Your debt is a burden, and your cash flow is limited.

- You’re having trouble achieving other financial objectives, including homeownership, because of your debt load.

Paying off your debt should be your first priority if it has a high-interest rate and is costing you money. If your debt-to-income ratio is more than 50%, you’ll find making purchases like a home challenging. You shouldn’t have a debt-to-income ratio of more than 43%.

When to Make Retirement Investments a Priority

You should put retirement investing ahead of paying off student loans:

- You can anticipate earning more on your investments than the interest rate on your student loans.

- You have faith in your ability to pay off your debt in the future.

- You are nevertheless able to reach other financial objectives despite your debt.

Keep in mind that deferring student loan payments in favor of retirement savings does not entail a complete cessation of debt repayment. Having student loan debt in retirement is not ideal, so you should make plans to pay it off. Always make the minimum payment first, then choose whether to apply any extra funds to your debt or retirement after that.

Steps to Choose Priority

Establishing a Rainy Day Fund

Let’s make a critical statement before delving deeply into the debate between loans and 401(k)s: Before making any other financial decisions, you must have an emergency or rainy day fund.

This emergency fund will keep you afloat in case anything unexpected happens. You’ll be happy to have this cash if you lose your job the same week that your automobile breaks down.

Statistics say that the total amount of student loan debt in the US is $1.745 trillion. Recent analytics show that the majority of customers appropriately handle their student loan debt, and the rate of debt creation is slowing.

Make the Most of Your 401(k) Contributions to at Least Receive the Match

Consideration of your qualifying company retirement plan should be your next top priority. You should fund your 401(k)—or 403(b) if you work for a nonprofit organization or 457(b) if you work for the government—as much as you can afford to, up to your employer’s match. Turning down “free money” by not making a sufficient contribution to obtain the match (typically 5% or 6%) is wrong.

Recognize the Difference Between Debt With High and Low-Interest Rates

Debt is not all created equal. Frequently, credit card debt carries a very high-interest rate that might reach double digits. Conversely, the interest rates for student loans are normally set at one percent. The interest on student loans is also tax deductible.

Even while you don’t want to miss any payments, you don’t need to be as aggressive with your student loan repayment as you would be with a high-interest loan like a credit card. Prioritize repaying high-interest debt before you attack your school loans forcefully.

Conclusion

Depending on your financial objectives and whatever option offers you a greater return, you should choose between paying off student debt and saving for retirement. Making minimal student loan payments while investing any surplus money may be a wise decision if the rate of return on investments is higher than the interest rate on your loans.

On the other hand, focusing on paying off your debt more quickly may be the wiser course of action if the interest on your student loans is larger than any potential return from saving for retirement.