Even under the best of circumstances, purchasing a house may be stressful, and it may seem downright overwhelming in a market with intense competition.

Understanding the critical stages helps you achieve your objective and turn your dream into reality, even if some details now seem different.

If you’re looking to purchase a house, this list might help you start your search in the proper direction.

There are additional considerations to evaluate before you make an offer and relocate, even if the number of rooms, the state of the kitchen, and the size of the yard are significant. Here are some things to check for when purchasing a house.

When looking to buy a home, there are many factors to consider beyond just the physical characteristics of the property. Location is a key factor to consider, including the proximity to amenities like schools, shopping, and entertainment. You should also research the crime rates in the area and consider the overall safety of the neighborhood. Additionally, it’s important to check for any potential zoning issues or environmental hazards that could impact the value or livability of the property. And of course, it’s crucial to work with a trusted and experienced real estate agent who can help you navigate the often complex process of buying a home, and provide you with up-to-date listings of homes for sale in florida.

Tips to Consider When Buying a House

Begin Your Research Early

Begin reading real estate-related websites, newspapers, and periodicals as soon as possible.

Note specific residences that intrigue you and observe how long they are on the market. Take note of any pricing adjustments as well.

This can provide you with an idea of housing trends in various locations.

Determine Your Housing Capability

If your down payment resources are limited, choose a house worth less than C$500,000 to qualify for a 5% down payment.

Try with any value in that price range if you have a nest egg large enough to put down 7.5% on the house priced between C $ 500,000 and C $ 1,000,000.

Experiment with various combinations of mortgage duration, kind, and interest rate. You’ll not only obtain multiple results but also learn how big of a difference a few basis points in a mortgage interest rate may have on the entire cost of a mortgage.

Compare your monthly income to the resultant mortgage payments. You could be prepared to proceed to the next stage if the payment amount fits comfortably within your budget.

If you have other loans, such as installment loans Ontario guaranteed approval then we strongly advise you to pay them off before taking out a mortgage.

If you have the total amount to buy a house, just look for options that are within your expectations.

Locate a Real Estate Agent

Getting expert assistance makes purchasing your home much more straightforward, even if you consider it as an optional item on your buying-a-house checklist.

A real estate agent may assist you with making an offer, answering any queries, pointing out features to look for in the properties, and negotiating a price with the sellers.

Furthermore, real estate brokers are often better educated about the market worth of other houses in the area and are aware of properties that should be promoted to the general public.

When a bank or financial institution offers a new house with a low-interest rate real estate brokers are generally the first to be notified, giving you an edge in locating a property before other purchasers know it’s on the market.

The House’s Location

Buyers desire to live in an area close to the locations they visit the most. Check for easy access to major roads and traffic flow.

You may avoid difficulties getting out of the neighborhood and onto the main road and an excessively lengthy commute by checking this out before making a purchase.

If there is a park, pool, or leisure facility nearby, some owners will choose the nearest accessible property.

Some individuals like cul-de-sacs, while others prefer living on the main street. Discuss your options with your agent, and determine if specific lot locations command a higher purchase price.

The Size of the Property

Many individuals overlook the property size on which the home is built. Lot sizes within a neighborhood are similar.

When you go to showings and look at what’s available, you’ll quickly notice whether you have a distinct preference.

Suppose there is doubt about where one lot ends and the other starts. Consult with your realtor regarding the lot description and measurements. Consider your options if you find a house on two lots.

Excellent HVAC

When looking for properties, inquire about the sort of heating and cooling system each one has and its age. You could also ask if there are any maintenance records available for inspection.

There’s a strong chance you’re safe if a home’s unit is less than ten years old and doesn’t have corrosion, water damage, suspicious-looking fissures, or strange noises emanating from it.

If you’re still concerned, keep in mind that a house inspection should uncover any severe flaws. After that, you may coordinate any requested repairs with your real estate agent.

Make a Home Inspection

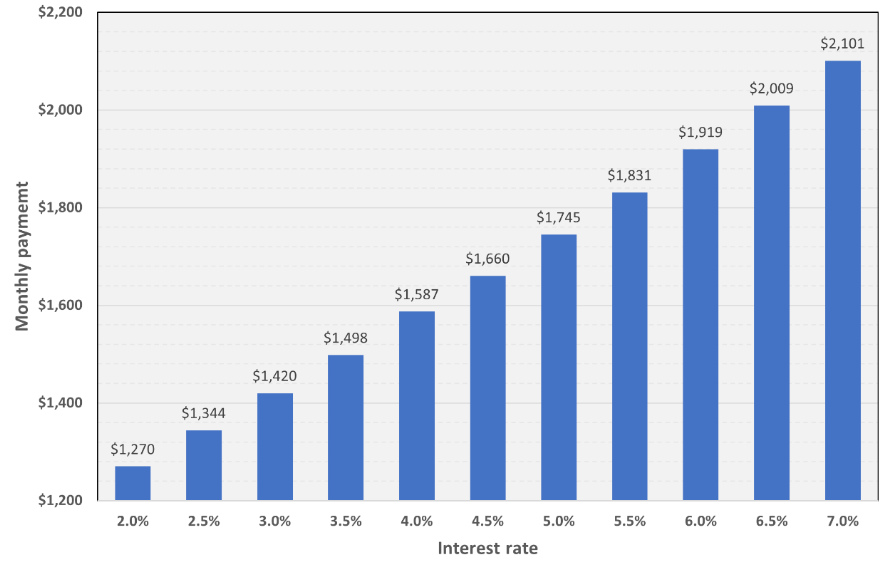

If you’re planning to take out a mortgage on your house, you probably won’t want to do expensive renovations in the coming years because if your interest rate rises to 7.5% and your mortgage are C$300,000, then you’ll be paying C$2,100 a month, which can hit your budget.

Example of monthly payments for a mortgage of $300,000 with an amortization of 25 years at various interest rates

Typically, purchase offers are subject to a property inspection to look for indications of structural deterioration or items that could require repairs.

After the seller accepts your offer, your real estate agent will often assist you in setting up this inspection for a short period.

If the assessment reveals substantial material damage, this contingency protects you by enabling you to renegotiate or withdraw your offer without penalty.

The results of the home inspector will be communicated to both you and the seller. Then you may choose whether you wish to request that the seller make any repairs to the property before finalizing the transaction.

Before the transaction is finalized, you can see the property and ensure that any agreed-upon repairs have been completed.

Conclusion

Finally, every home you look at will have advantages and disadvantages. You are responsible for choosing which parts you cannot live without, which you cannot live with, and which you are ready to compromise on.

Keep in mind that although it is essential to evaluate all the factors we covered while looking for your ideal house, no home will be without flaws.

Buying a new house might seem stressful, but the whole process will be much more manageable if you plan for it.